Introduction

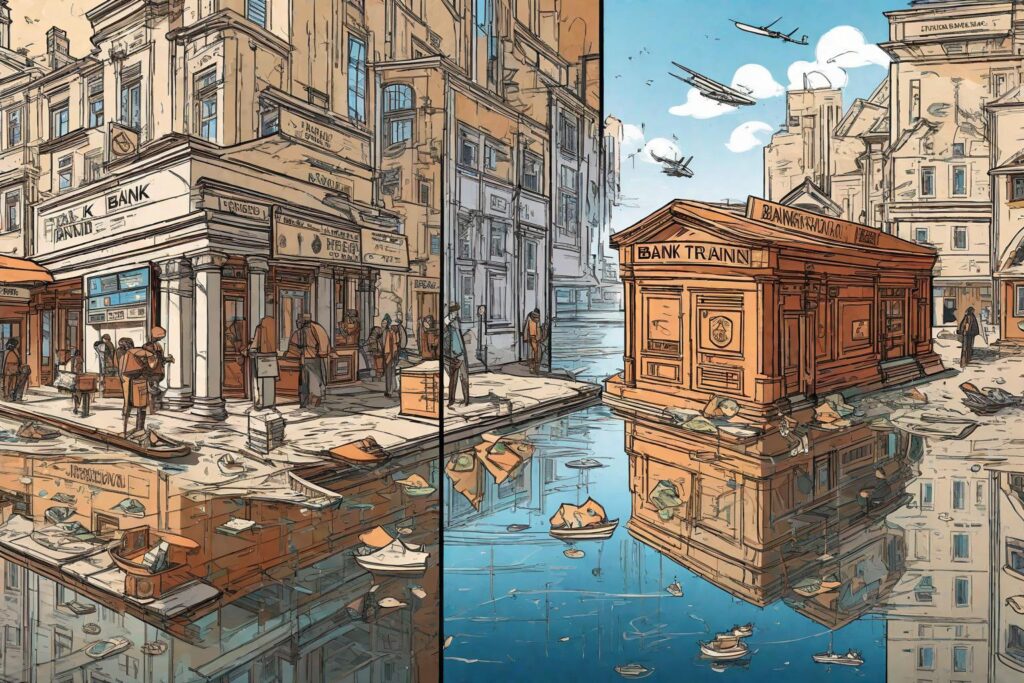

Ever dreamt of importing that exotic rug from Morocco or exporting your hand-crafted pottery to Tokyo? The exciting world of international trade awaits, but it’s not just about packing and shipping. At the heart of every cross-border transaction lies the complex realm of foreign exchange (forex) and trade financing.

So, who are the financial wizards behind the curtain, ensuring your international business ventures take flight? Enter the specialized trade finance banks!

Also read this what is credit interest capitalised?

Table of Contents

Which type of bank primarily deals with foreign exchange and international trade financing in india?

Here’s the lowdown:

- Regular Banks: These are your everyday commercial banks, handling personal and corporate banking needs like accounts, loans, and investments. While they may offer basic forex services, their expertise lies primarily in domestic financial transactions.

- Trade Finance Banks: These are the elite specialists when it comes to international trade. They are authorized by the Reserve Bank of India (RBI) to deal in foreign exchange and offer a suite of specialized services tailored to international trade needs. This includes:

- Foreign exchange (forex) transactions: Converting currencies, hedging against currency fluctuations, and providing liquidity for international payments.

- Trade finance solutions: Letters of credit, export bills discounting, supply chain financing, and other instruments to secure and expedite international trade transactions.

- Expert guidance: Navigating the often-complex web of international trade regulations and documentation.

So, when should you turn to a trade finance bank?

If you’re:

- An importer or exporter engaged in cross-border trade.

- A manufacturer or trader dealing with foreign suppliers or customers.

- An entrepreneur venturing into the exciting world of international commerce.

Benefits of Working with a Trade Finance Bank:

- Expertise: Gain access to specialized knowledge and experience in international trade and finance.

- Efficiency: Streamline your cross-border transactions and minimize delays.

- Security: Reduce financial risks and protect your business from fraud and non-payment.

- Competitive rates: Access competitive forex rates and financing options.

Leading Trade Finance Banks in India:

- State Bank of India (SBI)

- Export-Import Bank of India (EXIM Bank)

- Axis Bank

- ICICI Bank

- HDFC Bank

Now, you’re armed with the knowledge to navigate the labyrinth of foreign exchange and trade financing in India. Remember, choosing the right trade finance bank can be the difference between a smooth sailing international venture and a rough financial voyage. So, weigh your options, seek expert advice, and find the perfect financial partner to propel your business into the global arena!